It is the trend of global tax authorities are going to digitalize now. Tax authoritities are facing increasing pressure to streamline operation processes and increase tax revenue. Digitalization is one of the most efficient ways to achieve the objectives. Many tax authorities from the Government will preparer digitalization from either GST or VAT mechanism as this tax administration requires more frequent filing than other types of tax mechanism.

In addition, digitalization will also bring in the benefits of big data analytics for the tax authorities to understand the long term trends and patterns of their taxpayers. These big data analytics can use to justify the reasonableness of GST return and also become GST audit selection criteria.

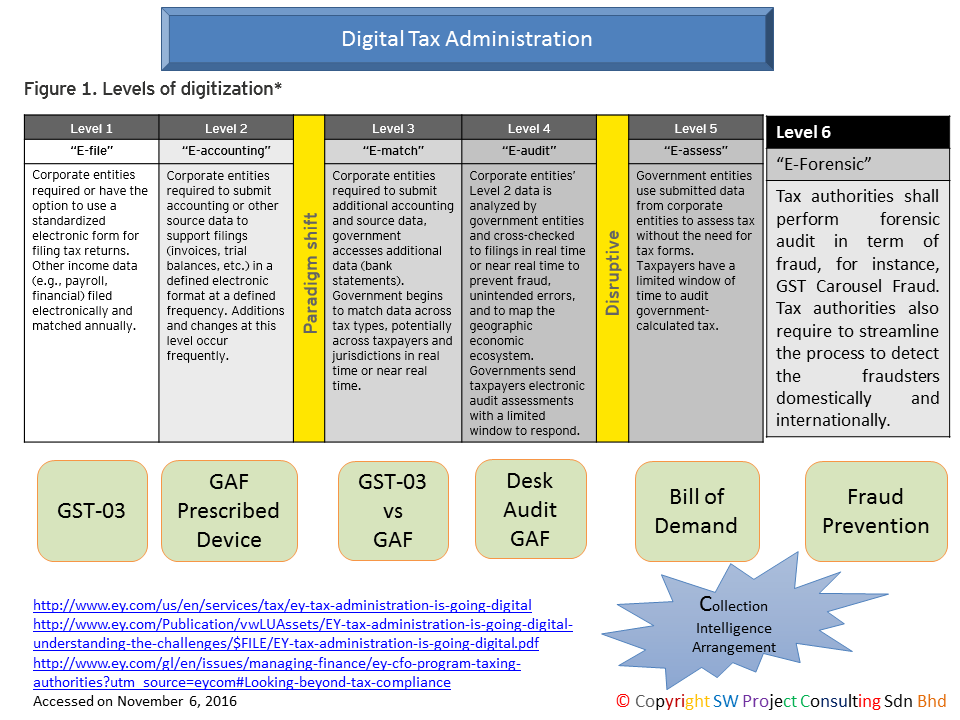

This article adopts a figure from the leading tax advisory firm and modify to fit the objective of this article. There are six levels of digitalization which comprise of the following:

- E-Filing - GST Registrants require to file return electronically via TAP

- E-Accounting - GST Registrants require to prepare prescribed format such as GST Audit File

- E-Match - Tax Authorities check on the reasonableness and match in the return submission

- E-Audit - Tax Authorities conduct GST Audit based on submitted return and prescribed GST Audit File

- E-Assess - Tax Authorities prepare assessment to the tax position of the GST Registrants after E-Audit

- E-Forensic - If data submitted triggers any frauds and wilful manipulation of the GST, the forensic operation shall conduct to investigate the frauds.