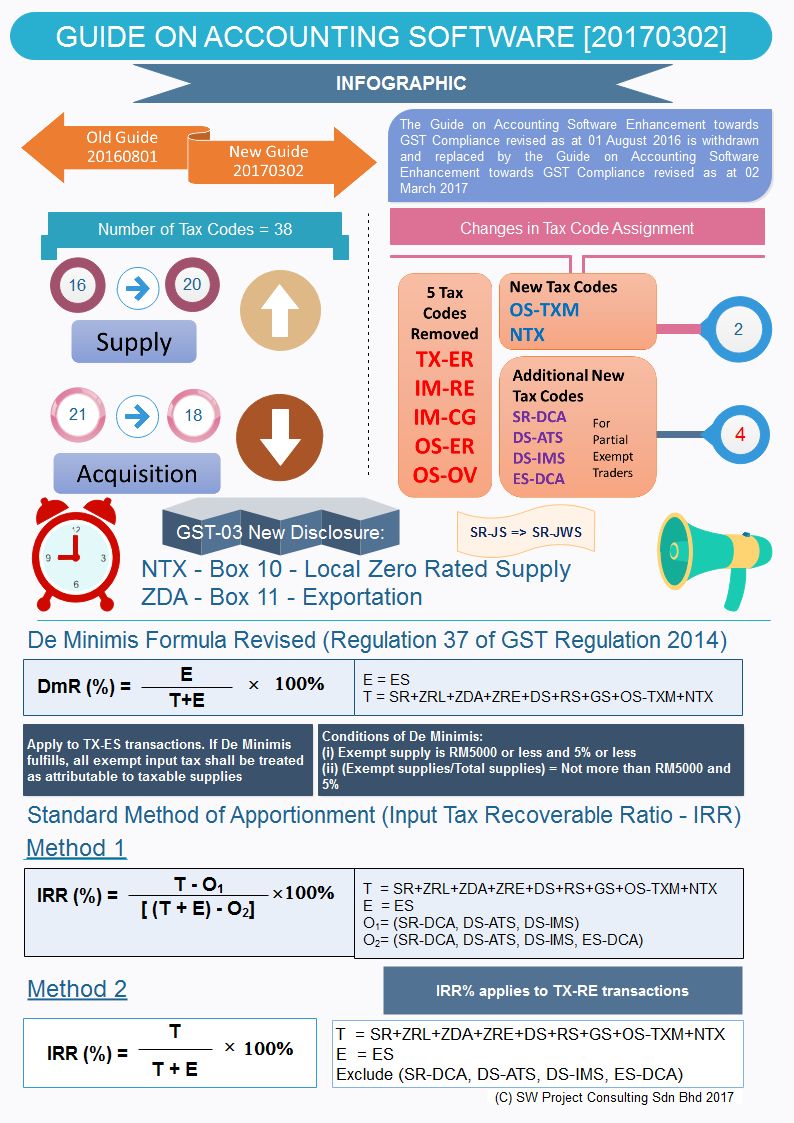

Guide on Accounting Software Enhancement towards GST Compliance was revised as at 02 March 2017 and replaced the existing Guide on Accounting Software Enhancement towards GST Compliance as at 01 August 2016. In this new guide, some tax codes have been removed and it also added new tax codes, thus currently it has a total of 38 tax codes. In addition, the De Minimis formula and standard method for Input Tax Recoverable Ratio have been revised.

The following is the highlight of the amendment in the guideline.

- Number of Tax Codes (38)

- There are changes in Tax Code Assignment

- GST-03 new disclosure requirement with tax code mapping

- De Minimis Rule formula is revised

- Input tax recoverable ratio formula is revised.

Please download the attach document to check the amendment in detail.

The below is the infographic on the amendment in Guide on Accounting Software.