Many businesses and organizations use different tax code for medical expenses for GST purpose.

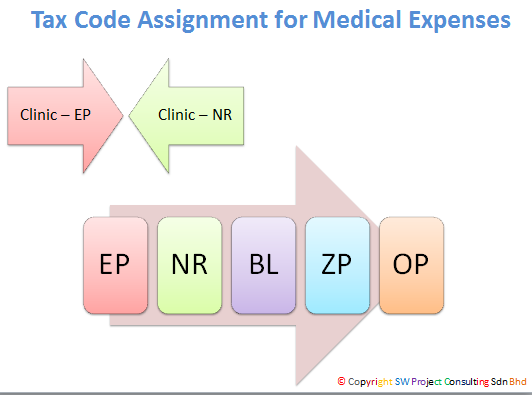

The following figure shows that businesses are using EP - Exempt Purchase or NR - Not Registrant for the clinical medical expenses. Actually, there are facts to support whether correct tax code (EP or NR) for the clinical medical fee. You may read the summary in the article.

Even though it is not an offence or serious wrong doing by assigning different tax code for medical expenses, I would rather follow the facts in the Act, regulations, guidelines and DG's decisions to assign correct tax code for medical expenses.

For medical expenses, it shall involve using the following five tax codes, generally:

- EP - Exempt Purchase according to Exempt Order Gazette 2014 and Amendments 2015

- NR - Not GST registrants

- BL - Block input tax credit for medical expenses incurred with GST

- ZP - Zero Rated purchases according to Zero Rated Order Gazette 2014 and Amendments 2015 - National Essential Medicine List

- OP - Out of scope medical expenses from government hospitals

Kindly download this article to understand the reason behind for the correct tax code to assign for medical expenses.