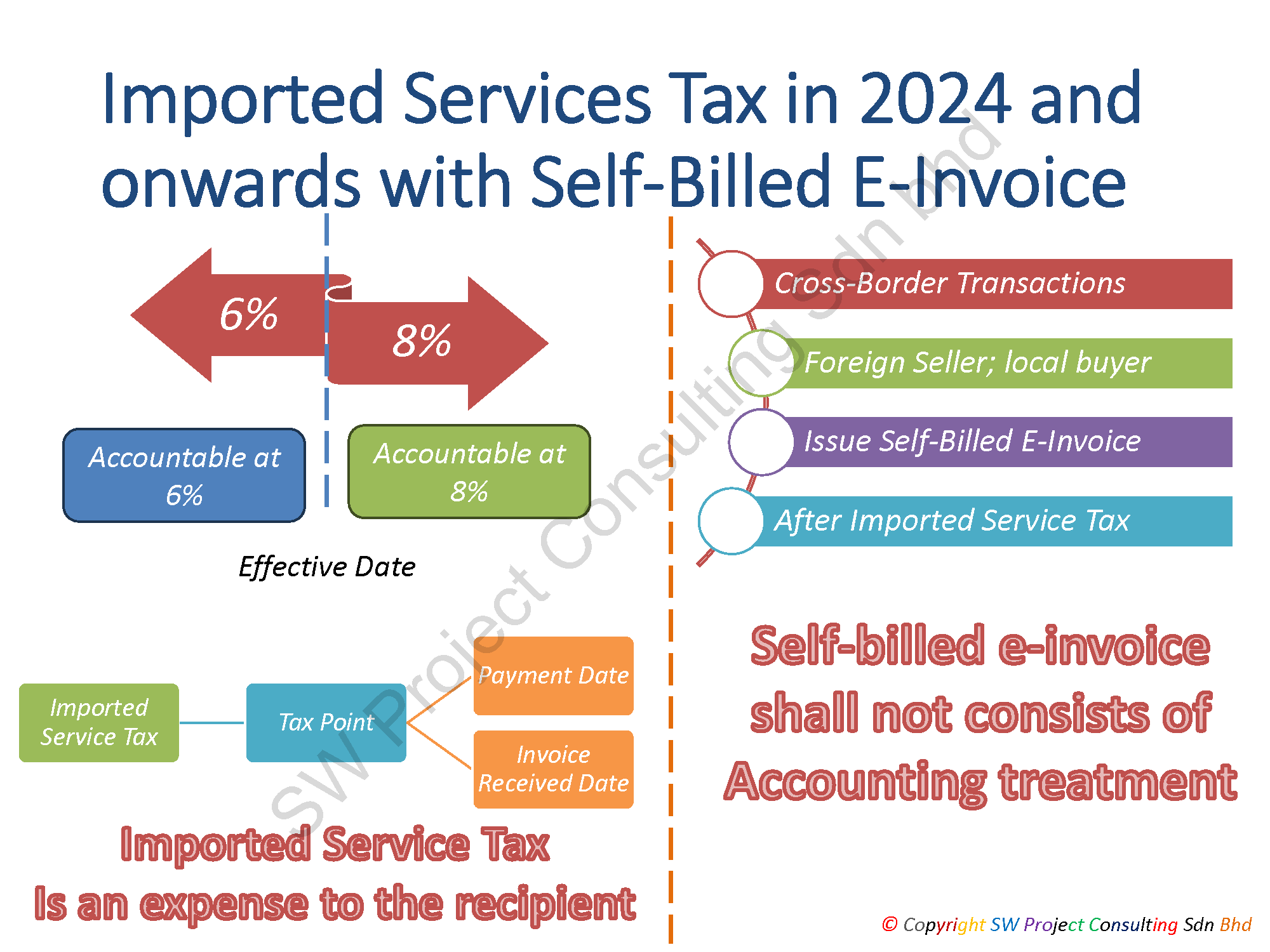

Imported Service Tax in 2024 onwards with Self-Billed E-Invoice

- Malaysia service tax will revise from 6% to 8% in 2024. Any imported taxable service before the effective date is subject to 6% and the tax rate will revise to 8% after effective date.

- Imported service tax in Malaysia is based on the payment date and invoice received date, whichever is earlier.

- Imported service tax is an expense to the recipient

Recipient of imported taxable service must prepare self-billed e-invoice after the payment of imported service tax.

The condition for the self-billed e-invoice as above:

- It is a cross-border transaction

- The recipient is acting as local buyer while foreign seller provides the taxable service, consumable in Malaysia

- To complete Self-Billed E-Invoice, the local buyer will now act as supplier as foreign seller.

- Local buyer as supplier will issue self-billed E-Invoice after the payment of imported service tax.

- There shall be no accounting impact for this self-billed e-invoice for imported taxable service.

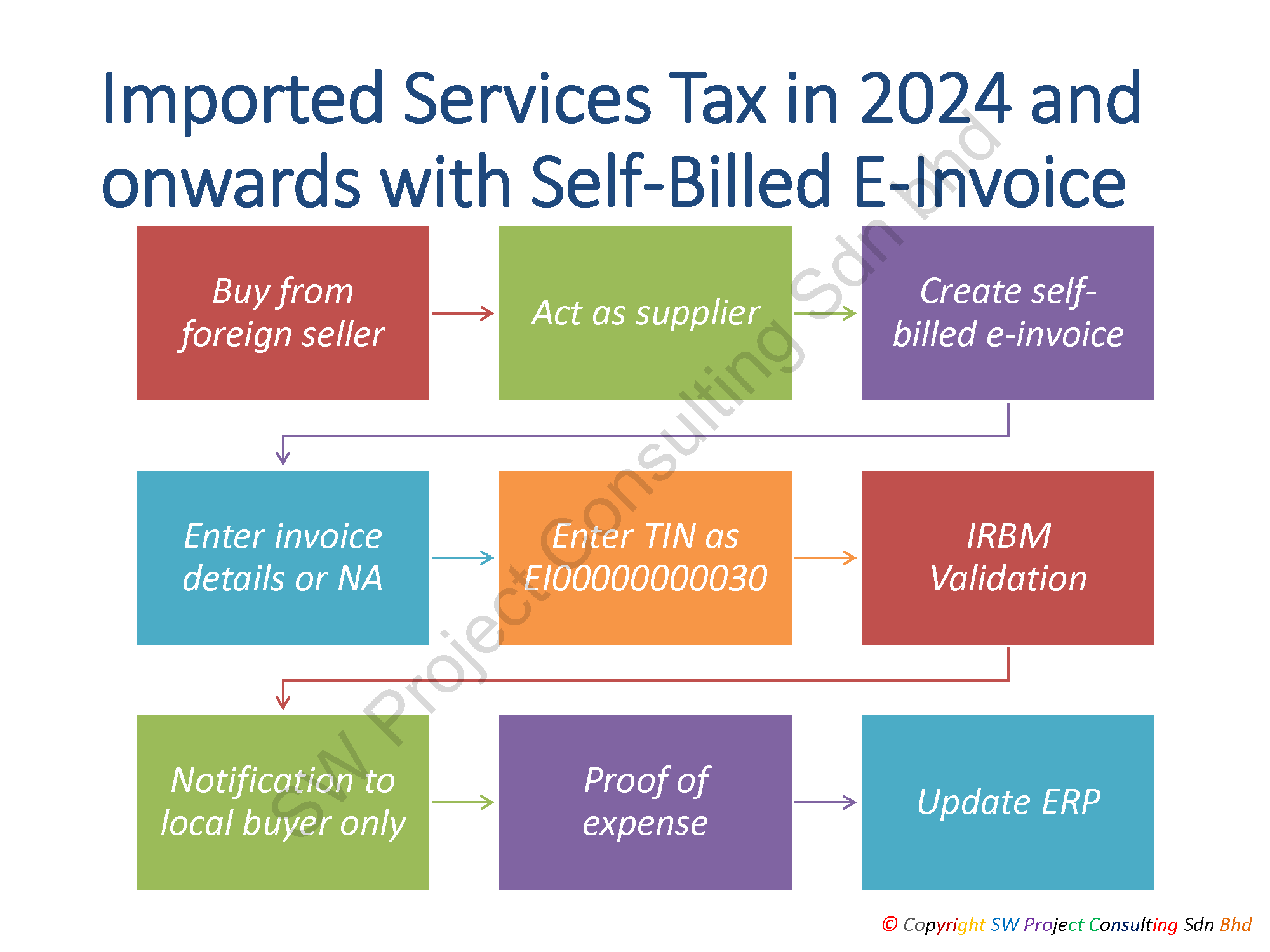

The flow of the self-billed e-invoice as below:

- Local buyer acquires taxable service from overseas service provider and completes payment for imported service tax

- Local buyer will act as supplier to issue self-billed e-invoice

- Local buyer will create self-billed e-invoice

- Local buyer can check with foreign seller for the details to be entered into self-billed e-invoice or enter NA if information is not available

- Local buyer will enter EI0000000030 as TIN - Tax Identification Number in self-billed e-invoice

- Once the e-invoice is created, it will send to IRBM for validation by API or access point

- IRBM will send notification to the local buyer only

- The self-billed e-invoice is viewed as proof of expense for tax purpose

- Local buyer will update or synchronize with ERP or accounting system