Tax code OS-OVN as per Guide on Accounting Software [20072016v2a]

This refers supplies made outside Malaysia which would not taxable if made in Malaysia. This tax code will be in O1 and O2 of the IRR formula.

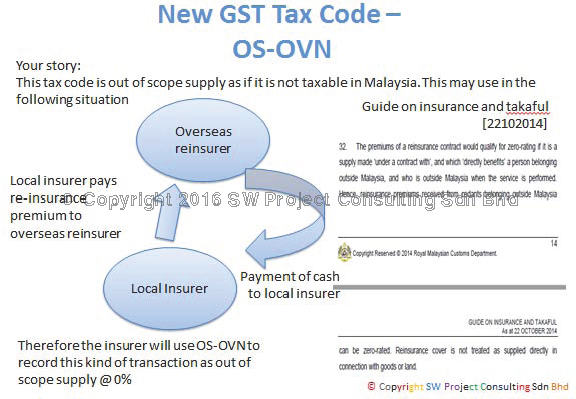

The following example illustrate on how a local insurer uses this tax code for re-insurance from overseas. A local insurer may engage overseas re-insurer to carry on reinsurance contract. Local insurer will pay reinsurance premium to overseas reinsurer and it may settle with recovery of cash payment from the overseas reinsurer. Insurance and takaful are not taxable in Malaysia and this transaction would qualify zero rated and direct benefits to a person outside Malaysia as per Paragraph 32 of Guide on Insurance and Takaful [22102014]

Tax code OS-OVN will therefore assign to this kind of transaction and this will be used in IRR calculation of local insurer whose carries on exempt supply business. The diagram below illustrates OS-OVN

Tax code OS-OVT as per Guide on Accounting Software [20072016v2a]

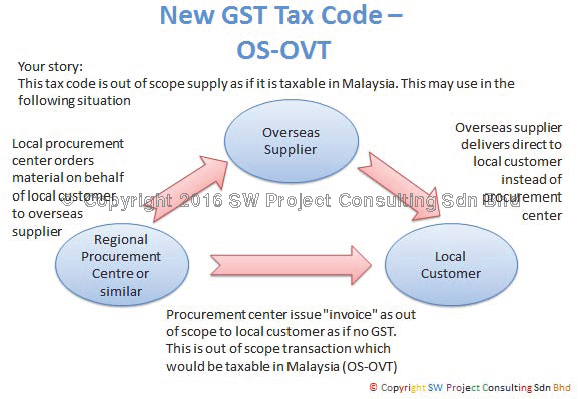

Tax code OS-OVT - This refers supplies made outside Malaysia which would be taxable if made in Malaysia

The example uses here is a regional procurement centre or a business which procures and sells goods in Malaysia. The goods is ordered to the overseas supplier but the delivery is directly sent to local customer instead of the business which procures and purchases the goods. This could happen due to the geographical arrangement and it is one of the drop shipment scenario. As the local customer uses its ATS to suspend the GST or pays GST on importation, the local customer will not require to pay GST again when it receives invoice from procurement centre. The procurement centre has to send invoice instead of tax invoice to the local customer. Therefore it is out of scope supply with tax code OS-OVT as the goods which would be taxable in Malaysia but out of scope. The diagram below shows the scenario.