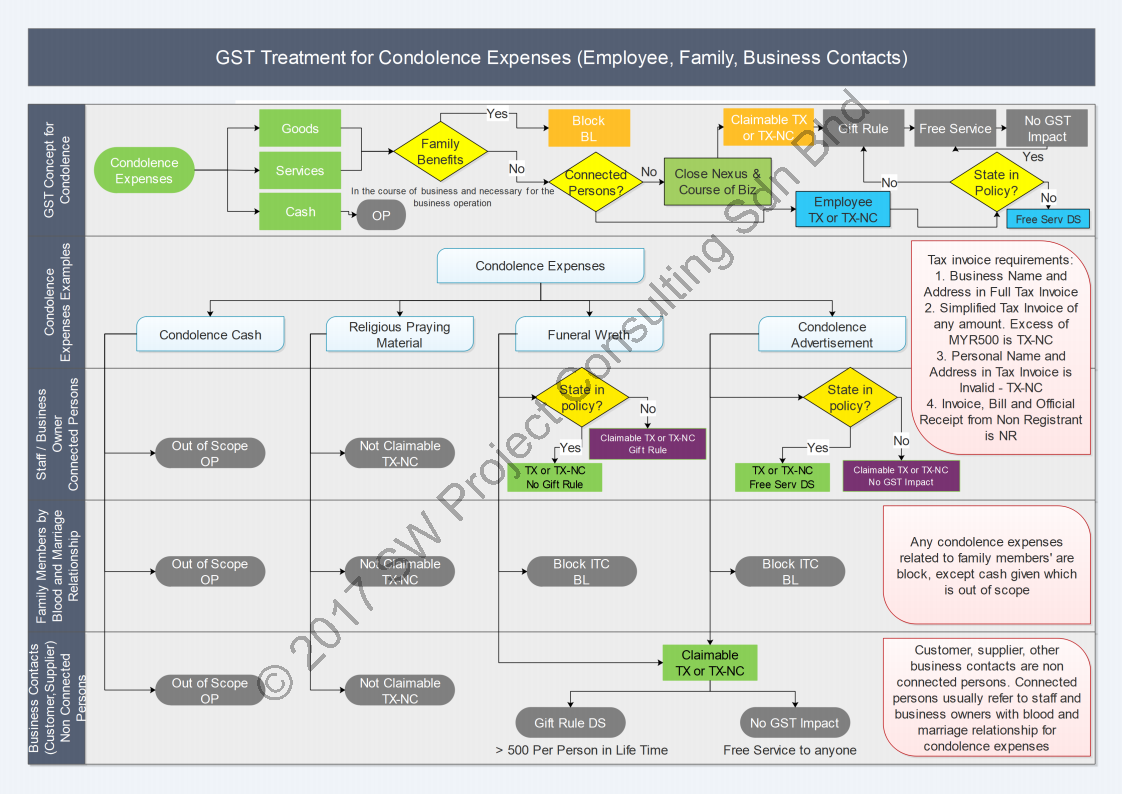

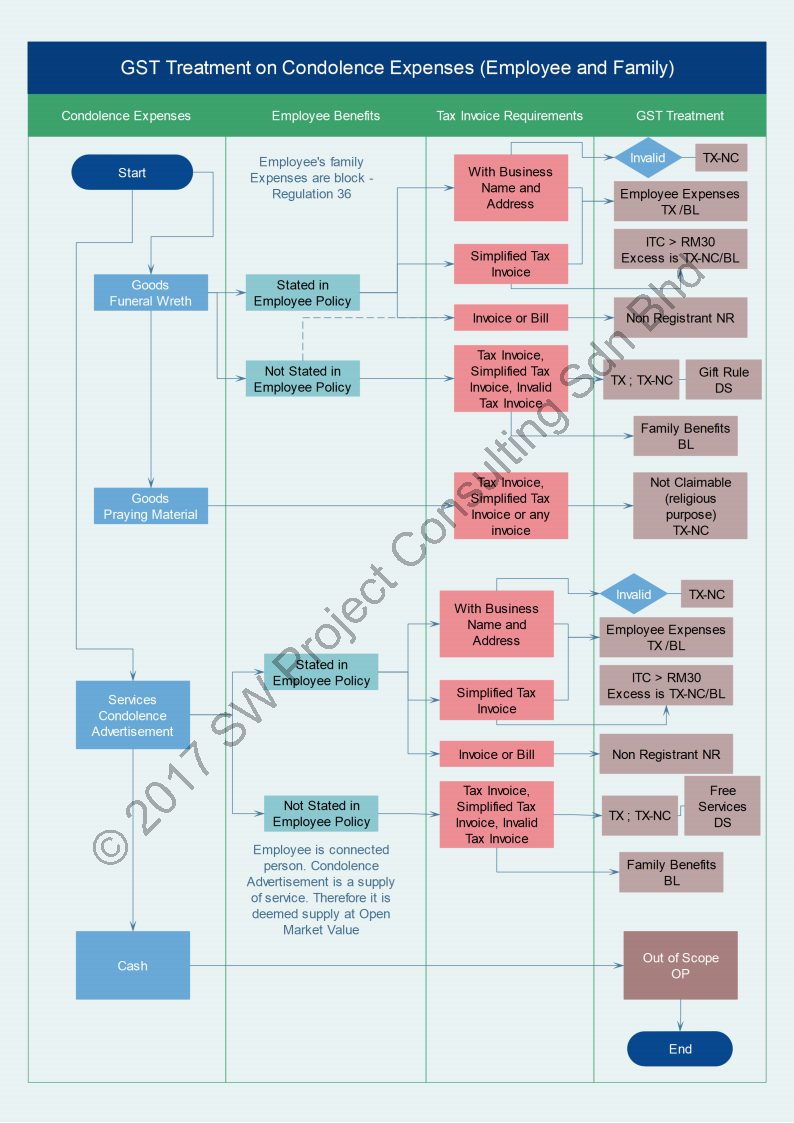

GST treatment for expense is always a challenging for the businesses to record correctly. GST treatment for condolence expense is another tricky area on whether claimable or non claimable expense for input tax credit. Shall it be subject to gift rule and other deemed supply in Malaysia?

This article is to summary the GST treatment for condolence expenses in Malaysia. The view may change from time to time. However, we use the following criteria and conditions to justify the condolence expenses.

Generally condolences given to a deceased person are either cash, condolence advertisement in the newspaper and funeral expenses. Funeral expenses can futher break into funeral decoration such as funeral wreth, religious and praying material. In order to qualify the criteria to claim input tax credit, let's examine the following conditions:

- Employment Policy - If condolence is given to the staff and family, is it written in the company employment policy and to be given to every deceased, not for a certain staff or family.

- Closed Nexus - Is it necessary for the proper operation of the business? (Singapore Reference)

- Is it a block item or disallowed by Regulation 36, GST Act 2014 - Family Benefits

- Does it possess valid tax invoice to claim input tax credit?

- Will gift rule and deemed supply trigger on such expenses?

The attached are two images related to GST treatment on condolence expenses. Each business will decide on whether to claim or not to claim the condolence expenses that they incurred. Click to see the enlarged image.