General introduction to Tax Code Assignment

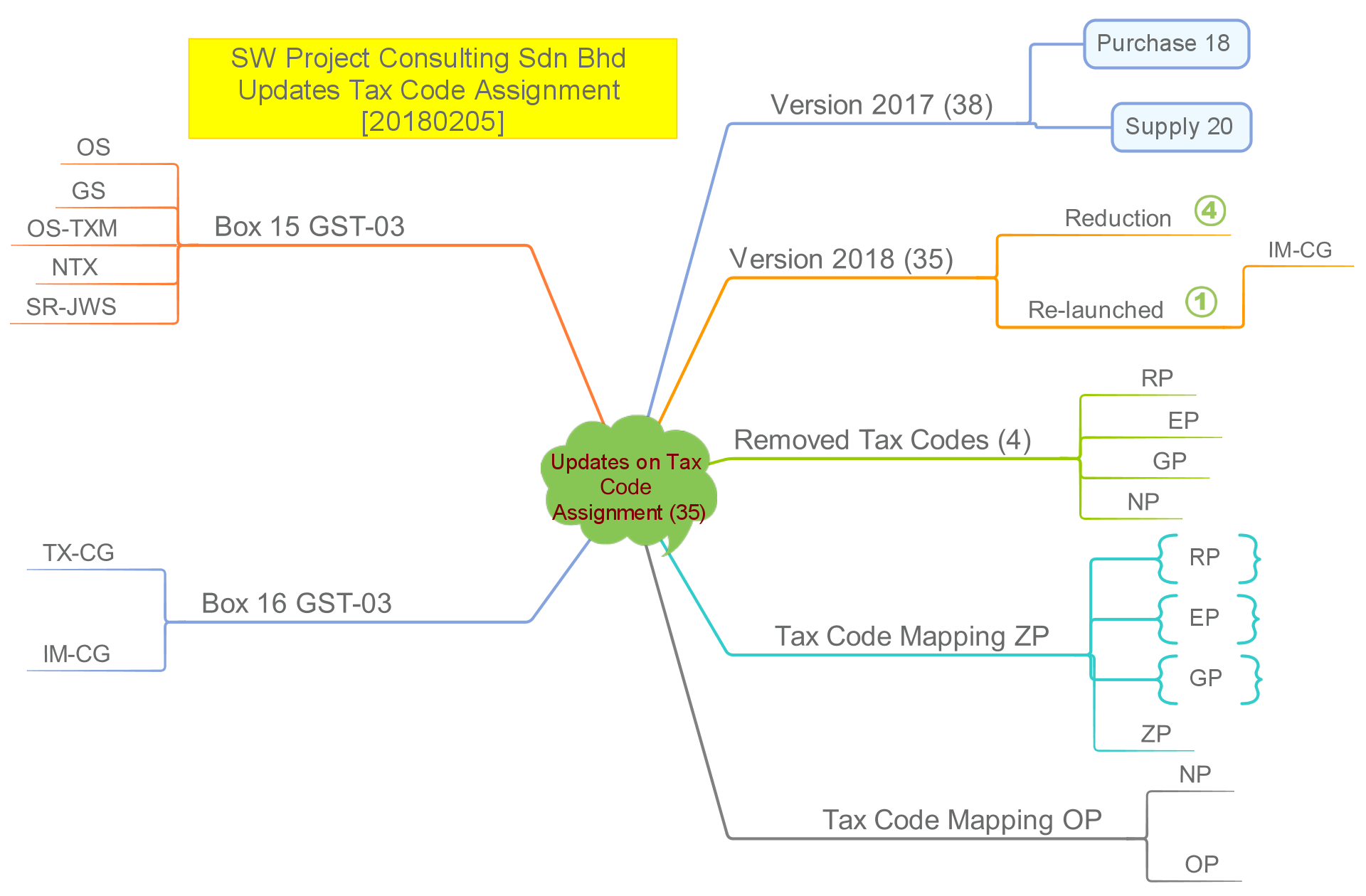

Tax code assignment in 2017 version consists of 38 tax codes, 20 for supply and 18 for purchase. RMCD revised guide on accounting software on February 5th 2018 and the latest Tax Code Assignment reduced to 35 tax codes. The tax code for supply remained 20 and tax code for purchase reduced to 15.

Tax Code Assignment

There were 4 tax codes being removed, EP, GP, NP, RP and 1 tax code (IM-CG) was re-launched.

Tax codes RP-Relief purchase, EP-Exempted purchase, GP-Group registration purchase and warehousing scheme are consolidated as ZP-Zero rated purchase.

Tax code NP-Not a purchase is consolidated as OP-Out of scope purchase.

Tax Code Mapping to GST-03 – Box 15

Box 15 is now classified as Total Value of Other Supplies. This should map to tax codes:

- OS - Out of scope supplies

- GS – Purchase from group registration and warehousing scheme purchase

- OS-TXM – Out of scope supplies which would be taxable if made in Malaysia

- NTX – Supply with no tax chargeable

- SR-JWS – Supply under Approved Jeweller Scheme (AJS)

Tax Code Mapping to GST-03 – Box 16

Box 16 is capital goods acquired. This should map to tax codes:

- TX-CG – Purchase with GST incurred for Capital Goods Acquisition.

- IM-CG – Importation of Capital Goods with GST incurred. (By referring Customs Form Number 1 (K1), and/or other reference documents)