The GST System Changes Blueprint

I mentioned about the system design document for the past few rounds of GST System Changes training conducted between July 2014 and October 2014. I gathered the feedback from the delegates and I walked through a GST System Changes project recently with a local company. I realized that it will be too late to discuss with software vendors about what the organization wants for GST Operation during system design workshop. The system consultants are too busy to start projects with many clients from different industrial background. System consultants may confuse with the treatment that applies to different industries. As such, it is the organization responsibility to develop a GST System Changes Blueprint to specify what are the essential requirements of the organization. For instance, importation of goods may occur frequently in manufacturer but not occur very frequent in advertising company. Building extra components may not help in the GST System Changes Project.

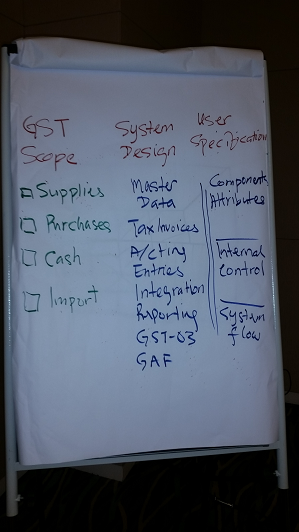

The picture above was the flipchart that I used in the training conducted on Aug 21 & 22, 2014 in Armada Hotel. I mentioned that this forms the System Design Document. I wish to bring it to higher level and become a GST System Changes Blueprint. It shall prepare during assessment and project planning stages. It can help to estimate the efforts and potential challenges to co-ordinate multiple software vendors to work together for system integration.

Software vendors may not know all the requirements despite of they are the owner or experienced agents on the software. Please take note that organizations took many years to develop their business and accounting software to the current state. The statutory needs to switch the current software into GST compliant in less than 180 days. Many business logics and changes not documented properly for years may not know the exact configuration in the systems. This increases the difficulty to modify the current systems for GST System Changes. The software may develop from many consultants and some were no longer working with the same software vendor. Highly customized software will face the challenges to understand the custmomized components that built previously by the sytem consultants.

Therefore organization shall take a step ahead to determine about what its wants for GST Operation by developing a GST System Changes Blueprint. It shall determine whether the existing processes can be maintained or new processes shall be developed to overcome the system challenges.

GST System Changes Blueprint shall form part of the GST Implementation Blueprint. It is a document that summarize the assessment on business and system domains for GST compliance. It identify the number of business systems involved in the organization that need to adopt system changes. Please take note that GST may impact many business systems than we can think about it. It is not only affecting accounting system but all systems that feed data into accounting system. For example, a Customer Relationship Management that processes Sales Quotation and Sales Order need to modify for the scope of GST and Procurement System that handles purchase requisition and purchase order need to display GST information. If those supply chain documents require matching with Tax Invoice and Purchase Tax Invoice, then the entire system flow for matching fields may need to re-design due to the changes in process logic and calculation sequence.

I break the GST System Changes Blueprint into three parts. The first part is GST Scope Identification. Organization has to assess their own scope of supplies. There are 5 types of supplies to determine -

- standard rated,

- zero-rated,

- exempted,

- out of scope and

- deemed supply.

Similarly organization needs to identify the purchases and expenses of which 7 types of classification can be determined -

- Purchase with GST,

- Purchase from non GST registrants,

- purchase of disallowed expenses or blocked input tax,

- importation of goods,

- out of scope purchase,

- exempt purchase and

- zero rated purchase.

Please take note that importation of services subject to reverse charge mechanism. Generally monetary transactions will not subject to GST. I add Employee Benefits as part of GST scope because it does have impact on goods for employee with consideration will trigger the GST. Please do not forget about the staff claim that involves GST Input Tax on purchases, local accommodation, medical expenses and others.

Lastly is the Capital Goods. Fixed Assets can now claim for GST Input Tax except for passenger cars. However, organization has to determine whether it will subject to any capital goods adjustment on its fixed assets.

The second part is the GST System Changes components:-

- Master setup,

- Tax invoice and supply chain format,

- GST Accounting,

- Integration between business systems and accounting system,

- GST Summary report, GST purchase and supply listing,

- GST-03 and

- GST Audit File.

As the organization uses the business systems, it shall know about the strength and limitation of their business systems. This part is to document about what changes to be made to the current systems to make it GST compliant. Certain key users in the organization has deeper and wide knowledge about their systems because they used for years. System consultants may have less experience than those senior end users. This part is to address whether the current systems able to support continuous system changes for GST compliant. It is up to software vendor to commit that it can be done or not.

The third part is system specification. It comprises of

- Component attributes,

- Internal controls and

- System workflow adoption.

The component attributes are the items whether the business and accounting systems can perform basic or advance GST functions. Basic function is necessary for handling GST Operation and advance features require for input tax recoverable ratio and handling of TX-RE. This will apply to any business systems as not all organizations use accounting system to generate tax invoice and supply chain documents. For example, organizations with e-commerce portal need to modify the process logic for GST calculation.

The internal controls address the data capture, process, output and storage. The permission control on data security ensures that only authorized users can use the system and the process logic shall enable the systems to rectify its errors if a transaction is going wrong. It gives the correct type of data output in correct format. It shall address on how to backup the business systems and accounting systems and a restoration in case of disaster recovery.

If GST impacts on the current system workflow, it may re-design the workflow. For example, staff claim may need additional column to record GST Input Tax. The system may trigger warning message for any GST Input Tax Credit more than MYR30 must submit only Full Tax Invoice.

Even though it has only a few months towards April 1, 2015, it is still necessary to prepare GST System Changes Blueprint for the efforts and clarity about what to change in the business and accounting systems. It may not surprise that many challenges in the system configuration and customization will surface during the course of GST System Changes Implementation.