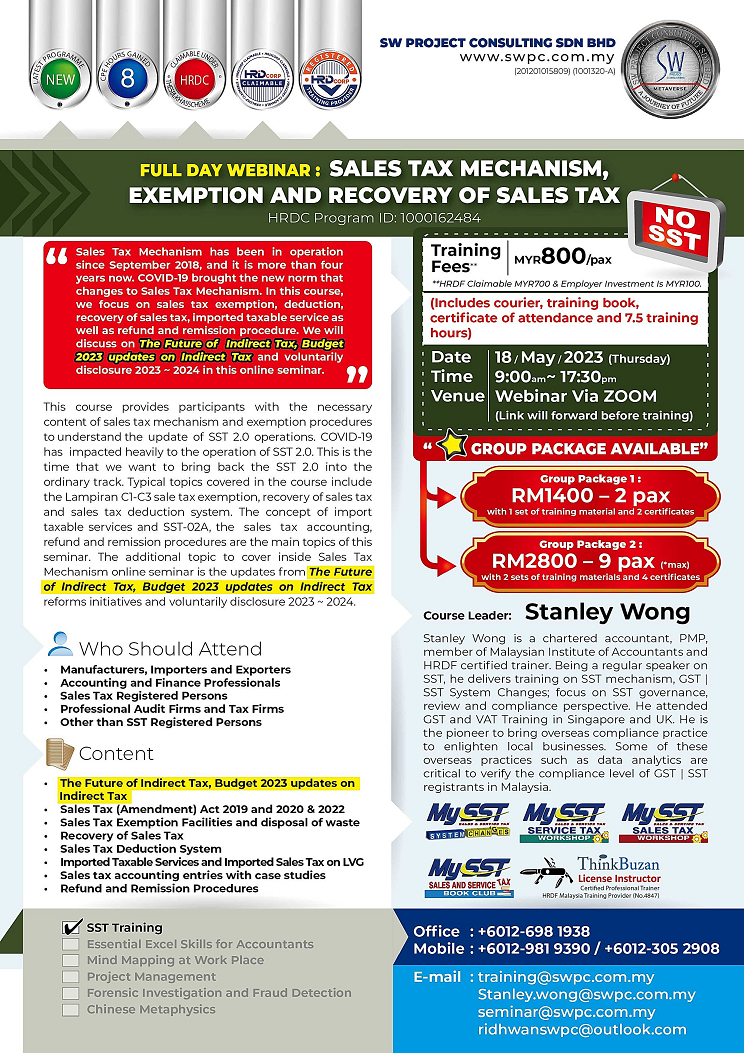

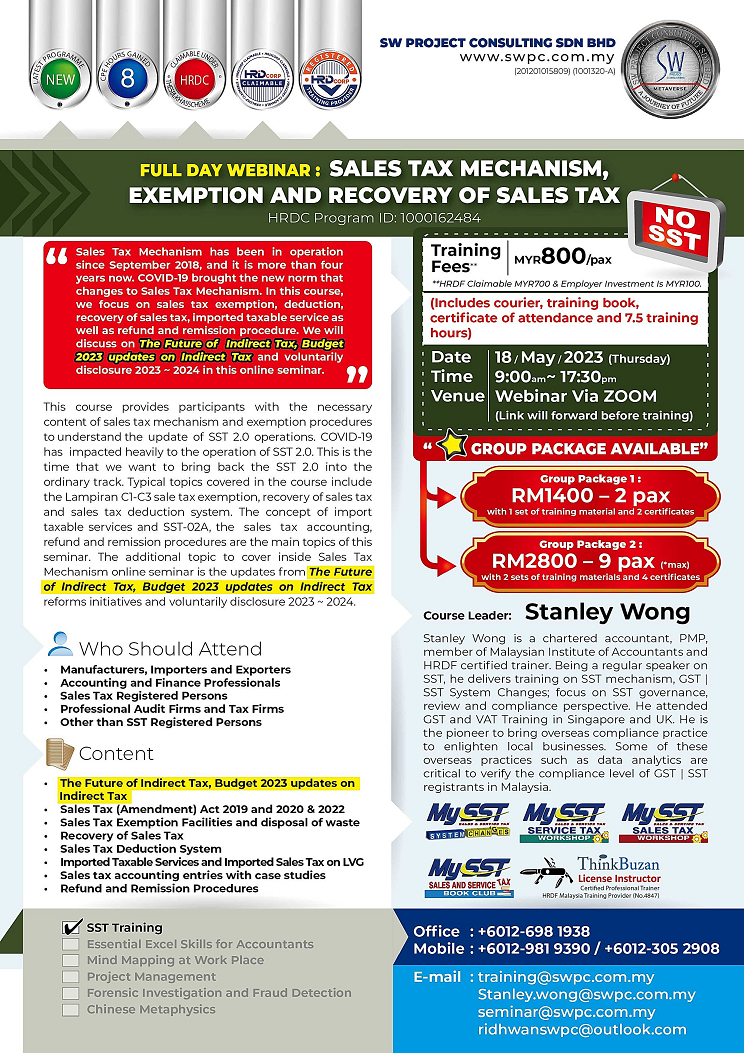

I would like to invite you and your colleagues to attend the Online Seminar - Sales Tax Mechanism, Exemption and Recovery of Sales Tax on May 18, 2023 (Thursday) [09:00 ~ 17:30]. Total 7.5 hours online seminar.

In this online seminar, it will include a session to discuss The Future Trend of Indirect Tax such as GST | VAT. We will also discuss about voluntarily disclosure in Budget 2023. We will highlight the path of indirect tax future in Malaysia.

Here are the top 9 reasons why it is important to attend this workshop:

1. The Future Trend of Indirect Tax in Malaysia and voluntarily disclosure in Budget 2023

2. Treatment, reasons for disposal of waste and recovery of sales tax from exempted purchase of raw materials.

3. Determine the correct tariff code from HS Explorer - Customs Duties Order 2022

4. Additional Sales Tax Exemption Form - C1-C3 form & SST-ADM Lampiran 1 & 2Form & Lampiran MIDA and 57A Form

5. Sales Tax Deduction Mechanism

6. Imported Taxable Services for Manufacturers and SST-02A Form

7. The purpose of Customs Ruling and Tariff Classification

8. Understand Refund and Remission Procedures for Sales Tax Matters

9. GST | VAT Reform and Blockchain Technology on Tax Collection

Click the image below to download the training flyer and registration form. Kindly fill up the form and scan to return to us by email. You can send to the email stated in the training flyer. Alternatively, feel free to contact us at 012-6981938 or 012-9819390 or WhatsApp us if you wish to speak to our training sales consultant.

Please download the training flyer via the download link or register using Online Form:

Online Seminar - Sales Tax Mechanism, Exemption and Recovery of Sales Tax

You can scan the QR Code to download to your mobile device using Wechat or QR Scanner.

Webinar

You can download the attachment in this article