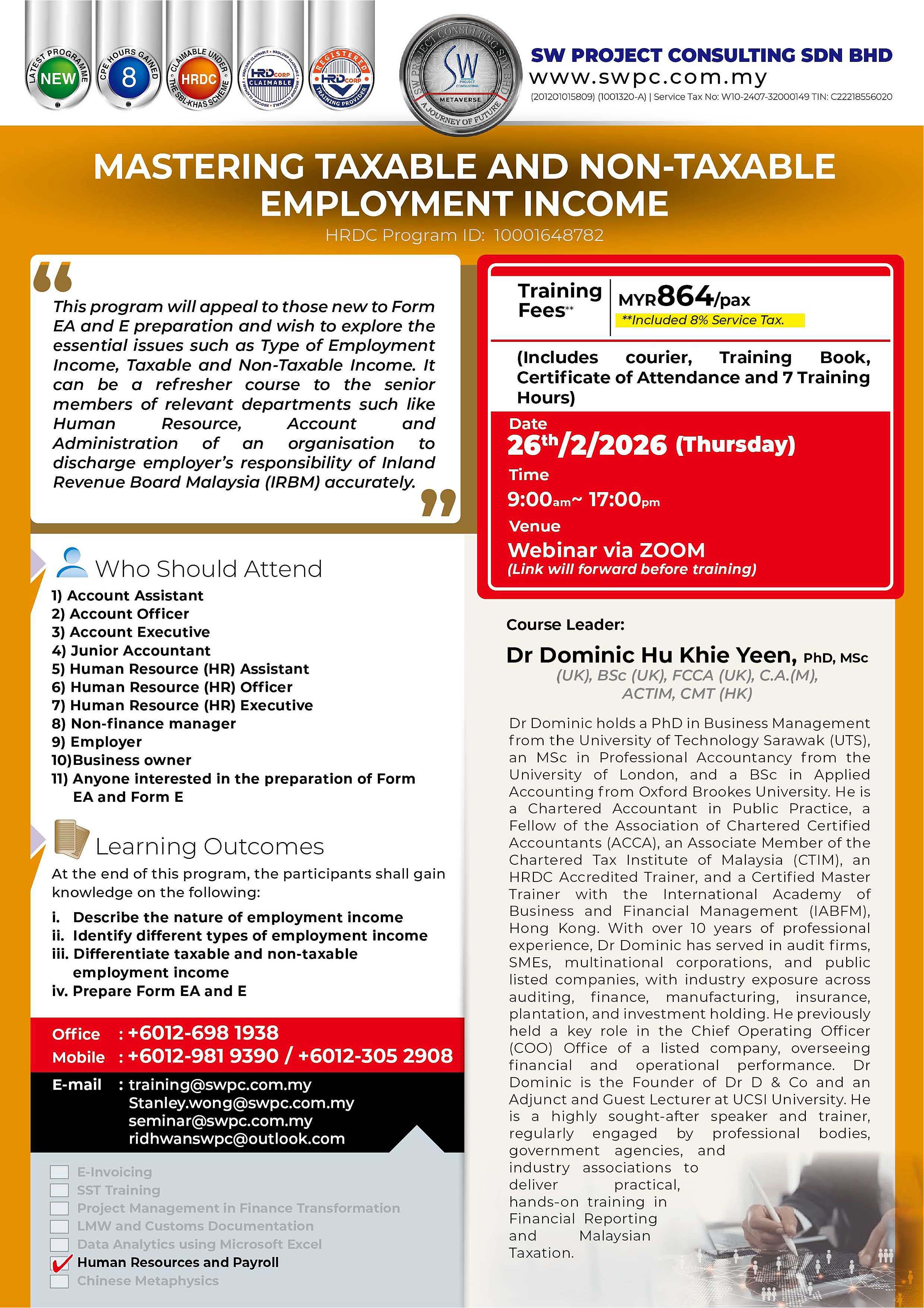

I would like to invite you and your colleagues to attend the Full-Day Webinar - Mastering Taxable and Non-Taxable Employment Income to be held via ZOOM on February 26, 2026 (Thursday) [09:00 ~ 17:00]. Total 7.0 hours online seminar.

In this online seminar, it will include a session to discuss nature of employment income, whether it is taxable or non-taxable, with the requirements in Form EA and Form E.

This online seminar is conducted by Dr. Dominic Hu. The below is the brief introduction to Dr. Dominic Hu.

Dr Dominic holds a PhD in Business Management from the University of Technology Sarawak (UTS), an MSc in Professional Accountancy from the University of London, and a BSc in Applied Accounting from Oxford Brookes University. He is a Chartered Accountant in Public Practice, a Fellow of the Association of Chartered Certified Accountants (ACCA), an Associate Member of the Chartered Tax Institute of Malaysia (CTIM), an HRDC Accredited Trainer, and a Certified Master Trainer with the International Academy of Business and Financial Management (IABFM), Hong Kong. With over 10 years of professional experience, Dr Dominic has served in audit firms, SMEs, multinational corporations, and public listed companies, with industry exposure across auditing, finance, manufacturing, insurance, plantation, and investment holding. He previously held a key role in the Chief Operating Officer (COO) Office of a listed company, overseeing financial and operational performance. Dr Dominic is the Founder of Dr D & Co and an Adjunct and Guest Lecturer at UCSI University. He is a highly sought-after speaker and trainer, regularly engaged by professional bodies, government agencies, and industry associations to deliver practical, hands-on training in Financial Reporting and Malaysian Taxation.

Here are the major agenda to attend this workshop:

1. Taxable and Non-Taxable Employment Income

2. Requirements in Form EA

Please download the training flyer via the download link:

Online seminar - Mastering Taxable and Non-Taxable Employment Income