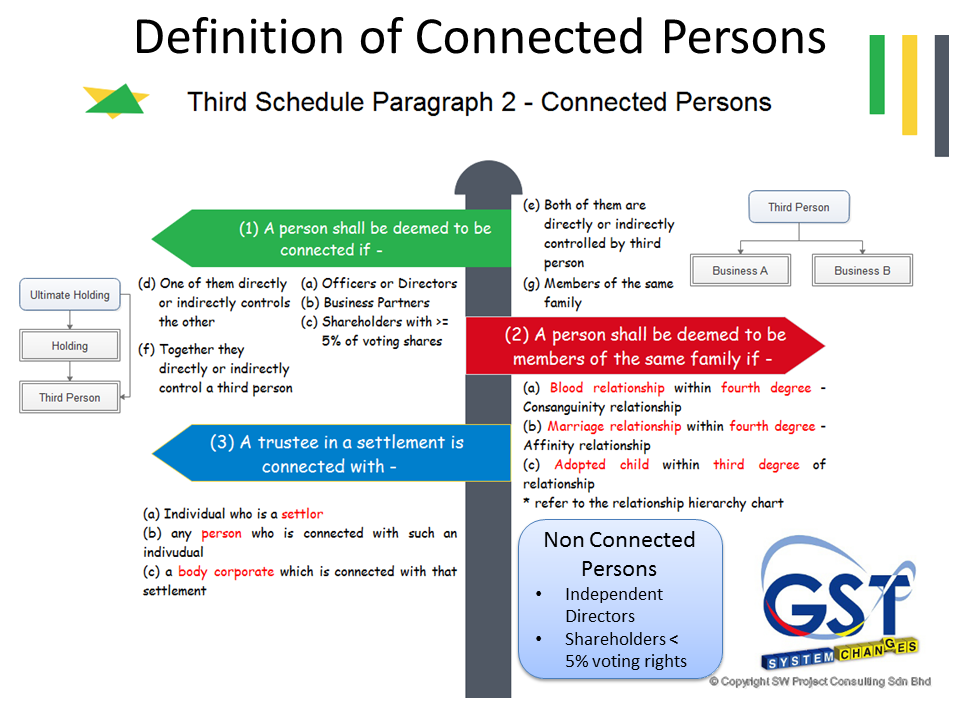

Third Schedule Paragraph 2 of GST Act 2014 mentioned the definition of connected persons. It is important for GST registrants to recognize the connected persons so that proper GST treatment can assign if there is any free offer given to connected persons and non-connected persons.

The first visual map is the summary of Third Schedule Paragraph 2. There are three groups of connected persons as per visual map.

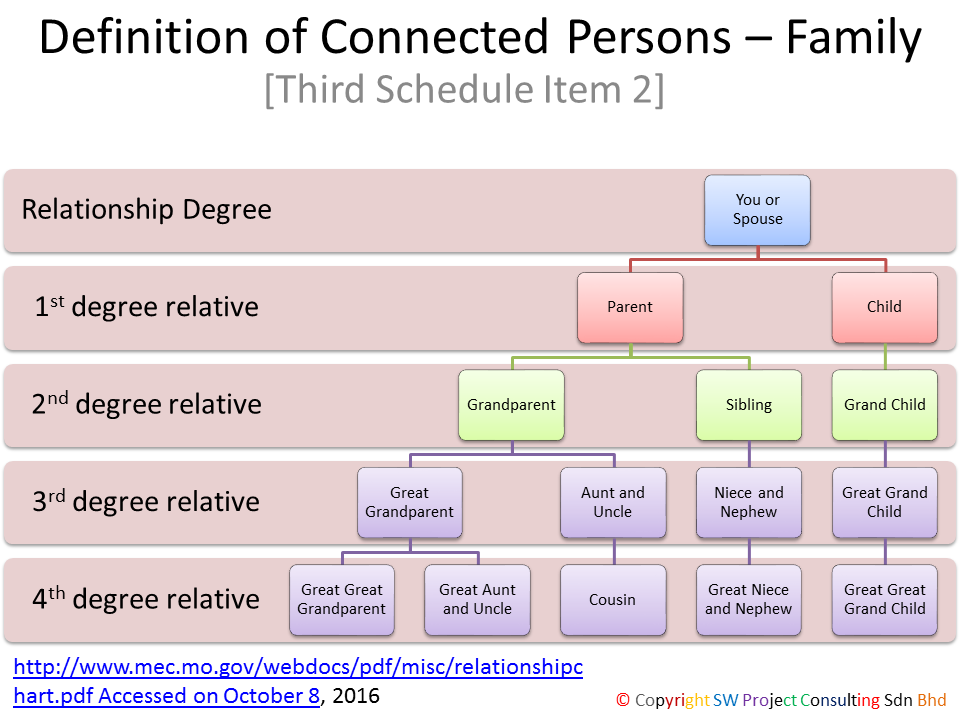

The second diagram is the relationship hierarchy chart by the number of degree in relationship. It moves upwards and downwards by 4th degree of relationship. It will trace within 3rd degree of relationship if it is an adopted child.

Consanguinity relationship is connected by blood. Affinity relationship is connected through marriage.

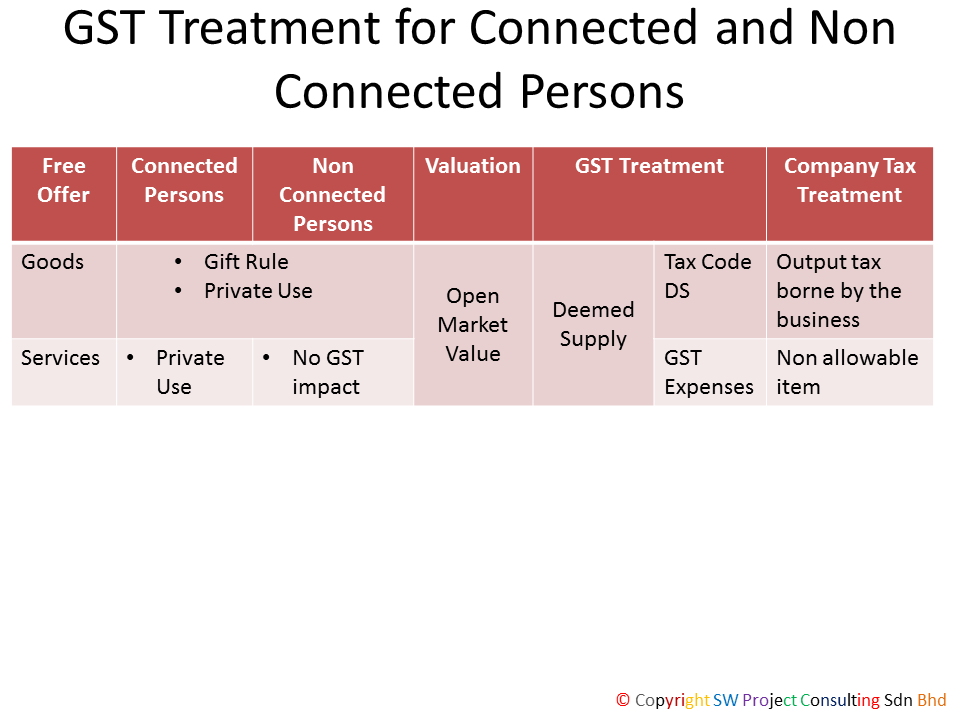

The third table is the summary of GST treatment if goods or services or both are freely offerred to connected persons and non connected persons. It is a deemed supply and GST registrant must account for GST but it is not an allowable tax deductible item.

If free service is offered to non-connected person, then there is no GST treatment as no consideration takes place. Giving free and receiving free of goods are not required to account for GST