Tax authorities are concerned on the compliance and control level of GST registrants. Most GST registrants are voluntarily compliant with GST laws but a number of GST registrants are unaware and negligent in term of GST compliance. This raises the concern of tax authorities. Tax authorities will take action such as GST audits, penalty and trade restriction as the measures to force the compliance level of GST registrants.

In order to maintain public confidence and avoid infringement to the laws, GST registrants shall voluntarily exercise its GST compliance and control as part of the corporate governance mechanism in their business model.

As tax authorities are convinced that the compliance and control structure exist and strong to account for GST in the business, this will reduce the chance to pick for GST audits.

Look at the Singapore's Assisted Compliance Assurance Programme (ACAP), this could become a potential model that our tax authorities may seek large tax payers and established businesses to voluntarily comply as a measure of governance.

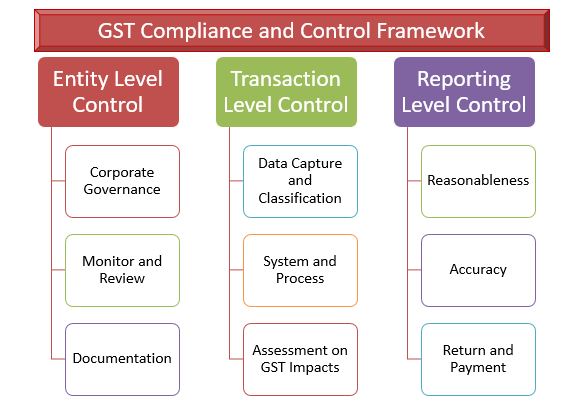

The below diagram suggests three levels of compliance control that shall exist in the business.

- Entity Level

- Transaction Level

- Reporting

- GST compliance and control mechanism is to be built into the scope of corporate governance.

- It is the responsibilities of the business to maintain proper documentation

- It is the responsibilities of the business to monitor and review GST operation.

- How the business captures transaction data and process the data accurately

- How the business classify different type of GST data by tax code

- Whether the system is able to cater for the GST scenario

- Whether the impact of GST scenario will reflect correctly in the GST return

- Pre-Filing Checking - Will the business perform reasonableness check prior to submission.

- Did the business aware about the analytics, trend and pattern in the submitted return?

- Is the submission that resulting refund or payment justifiable?